In a previous post, I defined this graph as “the most amazing graph of the 21st century.” It shows how the US oil production restarted growing in 2010, picking up speed and surpassing the historical record of the “Hubbert Peak,” which took place in 1970. It overcame the dip caused by the Covid pandemic and, two years after my first post on this subject, it keeps growing.

It was nearly miraculous, and you would think it was the effect of some supernatural entity that intervened. Did someone make human sacrifices to the Demon Baphomet? Or maybe summon some Chthonic Deities, maybe Cthulhu or Yog-Sothoth? Maybe it is not such a farfetched idea because the reversal was the result of a capricious and incorporeal entity not unlike ancient Gods: the mighty Market.

Faced with increasing costs and the decline of US oil production, the Market was indeed capricious. It could have directed financial resources to other energy technologies; nuclear, renewables, and coal were among the possible choices. Why was shale oil chosen? Anecdotes abound, but one thing is certain: if you look at the debate on oil production up to ca. 2010, you see that no expert in the field had predicted such a change.

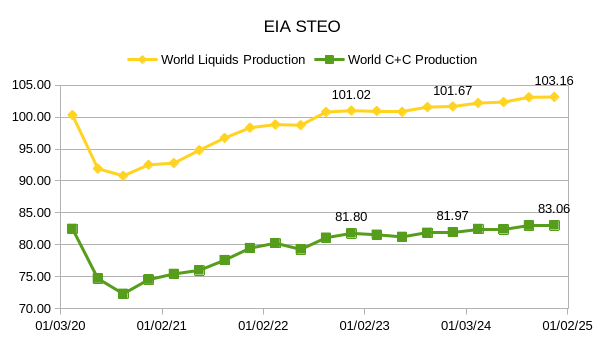

Is it a real miracle? Maybe not so much if you consider the whole world (data from PeakOilBarrel)

“STEO” stands for “short-term energy outlook,” the vertical scale is in million barrels per day. About the different names given to different kinds of oil, there is a certain degree of confusion, but in general, “C+C” includes conventional and unconventional oil, and also shale (“tight”) oil. All liquids include such things as natural gas condensates, biofuels, and refinery gains (which are not energy gains, but it is a long story. The world production of liquids is still increasing, but not so dramatically as in the US, which remains the only country extracting significant amounts of shale oil.

Why didn’t other countries follow the US in extracting shale oil? Another mystery that has probably to do with Baphomet, or maybe Cthulhu and Yog-Sothoth. Maybe the US is the only country with the right technology, or maybe it has special geological features, or it is a strategic choice to extract or not to extract shale oil, with other major world powers, e.g. China, having decided not to engage the heavy resources needed to develop shale oil extraction. They are rather focusing on other energy sources, mainly nuclear and renewables.

Indeed, that’s the fundamental point: extracting or not extracting a certain mineral resource is a strategic decision. And, no matter how impressive the curve is, it doesn’t matter how much oil you can extract; what matters is how much energy you can get from it after subtracting the energy used for extraction. Unfortunately, this data is not reported in the graphs of the various agencies that examine this field. But it is likely that “peak net energy” is already past and gone.

We can say that oil and military matters are strictly interlinked. Oil is used to build empires, and it is understandable that the US clings to it as a dominance weapon. But empires are expensive, and history teaches us that all past empires collapsed along a path involving military overspending. No oil - no empire. But expensive oil means a collapsing empire. Which is probably what we are going to see in the near future.

I can't remember who it was that first said "You can print money, but you can't print energy." This is mostly correct, but I think the US tight oil (shale oil) boom, along with Canadian tar sands and Venezuelan extra-heavy oil extraction, prove that we CAN print money and subsidize the extraction of large amounts of gross energy extraction. This is not to say that the yield of net usable fuels from those sources is particularly favorable. In the end, we end up subsidizing one form of low-EROI, high-value energy (diesel, jet fuel) with another temporarily more-plentiful local source (gas, in the instance of the extra-heavy oils) and/or unpayable debt.

I do know that many countries and even some US states consider fracking environmentally hazardous, and have banned it. Perhaps all of them that have the appropriate shale formations? Maybe.

However, I also suspect that Jon W may have put his finger on it with his comment about our ability to print money—the US, that is. I don’t have it completely worked out, but it may very well have something to do with two facts. The first is that the US dollar is the world’s reserve currency, and the US is the only country that can print almost with abandon and not suffer much of an immediate effect. The second is that for the most part, world oil prices are still quoted in dollars.

Everyone needs dollars to buy oil, which keeps the global demand for dollars high, so the US has continued to get away with it. One problem--the massive debt creation necessary to service US debt begets yet more debt, and all of it carries interest. The cost of US debt service is going exponential.

Somehow I suspect this financial alchemy has given the US an advantage, unique in the world, that allows them to occasionally ignore, at least for a time, the inconvenience of having production costs exceed the value of output.

One important function of money is to serve as a universal yardstick, a “unit of account”, to determine if a financial activity produces more wealth than it consumes. What is unique about the US is that it in essence owns the yardstick.

Of course, this whole system is in the process of some radical change. The international financial shenanigans set in motion by the happenings in Ukraine have put the global financial system on a fast track to some dramatic change. The effect on the US will not be good.